Buy Verified eToro Account

OWO!! Are you planning to Buy Verified eToro Account? Do not worry, you’re at the right spot. We offer safe and 100% verified accounts for our customers. All accounts are authentic. Therefore, you purchase authentic eToro account from us. We have an abundance of the top eToro Account for sale.

What exactly is what is an eToro account?

Trusted with millions of investors and traders across the globe, eToro is a controlled and stable platform. eToro is constantly coming up with fresh strategies and technology to enhance the trading experience of its customers including ProCharts as well as One Click Trading.

For those who have only a minimal knowledge of currency and forex trading it is a good choice. Customers from the United States no longer have to pay $5 for withdrawal charges however, customers from other countries have to pay $5.

pros

1.15 cryptocurrency that is able to be traded at any time of the day, seven days seven days a week

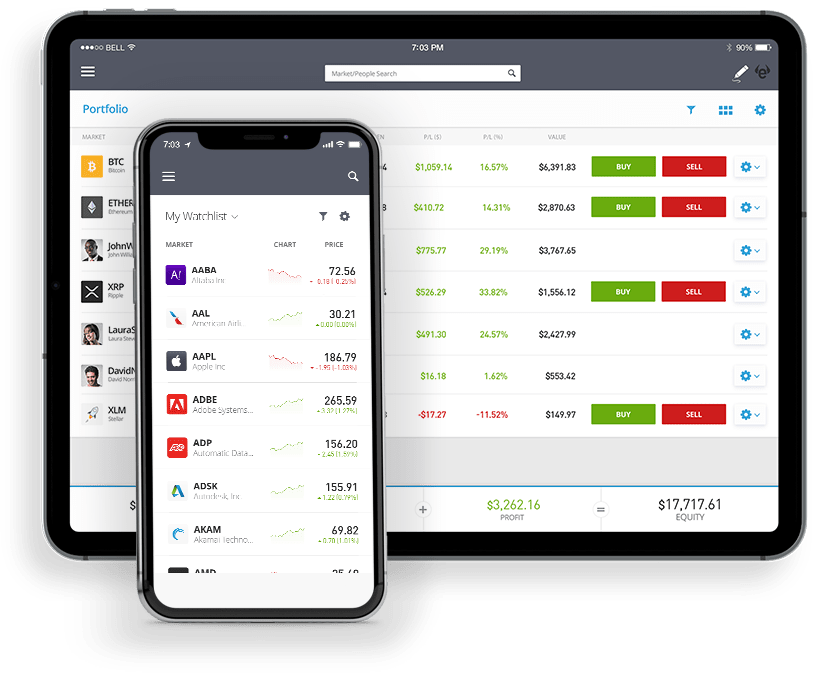

2.User-friendly mobile and website

3.Excellent Cryptocurrency Trading Group

Cons

1.The spreads for trading in cryptocurrencies are vast.

2.$25 will be the minimum price to purchase any cryptocurrency.

3.Most copy trading requires low minimums.

Pros Expledain

- Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and XRP are all readily available to people within the United States.

- The mobile app and the website are nearly identical, well-designed and easy to use.

- Traders should be aware of the actions of other members in the marketplace and follow suggestions of the members who advise you to replicate their trading strategies.

Cons Explained

- Trades are completed with specific spreads that vary between coins, but there isn’t any clear commissions to be paid. Certain margins are extremely broad.

- The minimum purchase amount for each cryptocurrency is 25 dollars. This makes it difficult for accounts with smaller balances to diversify their portfolios beyond a handful of coins.

- You can copy the trading patterns of some famous traders However, you’ll need an additional balance to replicate their trading patterns. For every copy of an exchange, the majority of companies require an amount of at least $200.

How we rated fees?

Based on the way eToro’s charges are compared to the fees of all evaluated brokers, we scored them as average, low or even strong.

Let’s get started by defining some terms that are related to broker fees. The fees for trading and those that are not traded are two areas to be aware of.

- If you sell your business you’ll incur charges for trading. Spreads, commissions, cost of borrowing and transfer fees are some examples of these.

- Non-trading costs include things like redemption charges and inactivity fees that aren’t directly tied to trading.

The most crucial eToro charges for every asset class are listed within the following sections. Spreads, commissions along with borrowing fees, like are the most important charges in stock and forex index trading.

We also evaluated the fees that are charged by eToro against those of two brokers that are related, XTB and Trading 212. The choice was made dependent on objective standards like the services that are offered, the profile of the client and the fee structure and the list goes on. A complete listing of eToro alternatives is available here.

Let’s look at the trading fees in order to see a clearer picture of eToro.

Types of accounts

There are two kinds of accounts available from eToro Account which are a live account and Demo (or virtual) account that lets you test the platform by using fake money.

How do you open your account?

The process of opening an account is easy and completely digital. It’s also speedy and easy, since we were able to create an account in under one day.

To begin to begin, sign up using the email you used to sign up, your Facebook login, as well as a Google+ account. You’re done; login into the online trading system and start trading with a virtual $100,000 account.

If you’d like to go higher and finance it using actual money, you’ll have to submit the following documents to establish your identity and proof of residence:

1.Identity evidence: A copy of your driver’s or passport.

2.A duplicate of an utility bill or bank statement to prove residence.

Options and fees for deposits

There are many deposit options, as you would find with others CFD brokers:

- Transfers to banks

- Credit/Debit card

- PayPal

- Skrill

- Neteller

- China UnionPay

- Klarna / Sofort Banking

In some regions, eToro may require a credit or debit card, or a bank transfer for the initial deposit and electronic wallets can only be accepted for deposits that follow.

Transfers to banks take 4-7 business days to complete and there’s no limit on the amount that you can deposit. Although credit/debit card or electronic wallet deposits are made immediately however, these are subject to the following transaction limit of $40,000 for credit/debit cards , and between $10,000 and $30,000 (Klarna) for electronic wallets. Buy eToro business account.

You can only make deposits on accounts registered in your name.

eToro charges for withdrawal and alternatives

In contrast with the other CFD brokerages, eToro Account charges a $5 withdrawal fee that is a significant amount. The withdrawals at eToro are also limited to a minimum amount of $30.

The withdrawal options are comparable to the options for funding: you can withdraw funds using a the bank transfer, credit/debit card or digital wallets as with other CFD brokers.

How do you withdraw funds from eToro?

1.From the menu left of the screen choose the tab ‘Withdraw Funds’.

2.Input the amount you wish to withdraw (in dollars).

3.Fill electronically the withdrawal form completely.

4.Click the button ‘Submit.

Security and login

A secure two-step login procedure is accessible on eToro Account. It can make signing in harder, but it also gives you greater security.

Cryptocurrency

The rates of cryptocurrency fluctuate greatly which makes them ineffective for investors of all kinds. The trading of cryptocurrencies is not regulated in the EU regulation system like MiFID II. This means that there is no security for investors in using the eToro Cryptocurrencies Trading Service.

Is eToro regulated?

Yes there is a Cyprus Securities and Exchange Commission (CySEC) as well as it is the Financial Conduct Authority (FCA) of the United Kingdom, and the Australian Securities and Investment Commission supervise this (ASIC).

eToro was established by the company in 2007. It is located in Israel.

Is eToro safe?

We strongly recommend that you double-check the following two facts to be certain of:

1.How do you protect yourself in case there is a problem?

2.what is the background of the broker?

How can you be protected

Customers are serviced by three legal entities within eToro in accordance with their place of residence. This is significant since the entity that you are a part of is the determining factor in the level of security you receive.

- The citizens who reside in those from the United Kingdom can open an account with eToro Account (UK) Limited, which is managed by the Financial Conduct Authority (FCA). eToro UK clients should expect to receive the entire amount of PS85,000, which is guaranteed through the Financial Services Compensation Scheme if eToro is declared insolvent (FSCS).

- eToro Australia, which is controlled by ASIC (Australian Securities and Investments Commission) and provides Australian customers. ASIC is, on the contrary side, doesn’t offer any type of compulsory investor security that is based on a specific number.

- Other traders with live trading accounts be held with eToro (Europe) Limited, that is overseen by CySEC which is the Cypriot regulator. A maximum of insurance for investments that is available through eToro Europe is EUR20,000. It is set by the Cypriot Investors Compensation Fund sets this amount.

All customers who have been signed up to these three companies are covered by eToro’s own insurance. It’s a PS1,000,000 policy which covers shares, cash and CFDs. It’s provided through Lloyd’s and is offered in the event that eToro is declared bankruptcy. This is a great change as many brokers do not exceed the legal requirements. However, eToro reserves the right to close your etoro business account at any point.

What is the process behind eToro function?

eToro is mostly an exchange broker and CFD however, it also provides live stock, ETF, and trading on cryptocurrency. It’s well-known because of its “social trade” feature that lets you track and duplicate the trading portfolios of another eToro Account trader.

How do eToro earn money?

eToro earns money by charging various fees and providing trading and trading services through their website. The main source of income for eToro even though it doesn’t release their financial statements will likely be:

- Spreads refer to the difference in prices between you and the broker in the event that you sell or buy. Simply put, if Apple stock is worth $10 at the time of auction eToro will charge $100.1 to purchase it. eToro Account keep any difference, which is $0.1 for each CFD. Find out more about the way CFDs work to find out more information.

- eToro overnight fees In order to make this happen you’ll need to be aware of two concepts such as leveraged loans and leveraged trades. It is possible to trade for more capital than what you’ve got when you leverage. Let’s say you have $10 and wish to exchange Apple using an leverage rate of 1:10. This means you could purchase the value of $100 in Apple using 10 dollars through leverage. The remaining $90 will be loaned directly to you through eToro Account which will charge you an amount (interest) on the borrowed amount.

- Other non-trading charges: eToro Account charges non-trading fees for a range of products on their site that aren’t specifically tied to trading. These fees are not related to trading:

1.Withdrawal charges ($5 for each transaction) Pay to take your cash taken out from your bank.

2.conversion charges: When eToro transfers funds to accounts, the user have to pay these charges.

Can eToro Account be reliable?

CySEC within Cyprus, ASIC in Australia ASIC in Australia and ASIC in Australia, and FCA within The FCA of the United Kingdom all control eToro. This is a good thing. eToro has not been a listed firm and doesn’t release its financial statements. eToro is not a scam however, it is not a fully open broker, as per BrokerChooser.

Are eToro Account profits taxable?

If you make use of eToro trading, you’ll be bound by taxes and rules. It is typically determined by the country of your birth. We recommend contacting your local tax authority to get additional information about eToro Account as well as taxes.

Customer Service

Customers who have accounts less than $5,000 can seek support online or send a ticket for assistance to eToro’s customer support. If you’ve discovered the blue light connection to the chat feature where you can talk to an agent live. Customers of various grades in eToro’s Club will be assigned an account manager until they’ve reached an account balance of $5,000 or more.Accounts that have a balance at or above $25,000 in level Platinum Club levels or greater get benefits such as Priority customer care. Priority service is highly appreciated as normal customer service may take up fourteen days to respond.

Buy Active eToro Account

eToro has a wealth of features and benefits. Trusted with millions of investors and traders all over the world, eToro is a controlled and stable platform. eToro Account is constantly coming up with innovative strategies and technology to enhance the trading experience of its customers including ProCharts as well as One Click Trading. For those who have a basic knowledge of currency and forex trading this platform is ideal. Customers from the United States no longer have to pay a withdrawal fee of $5 However, customers from other countries have to pay $5.

It’s fantastic for business as well as other uses. Therefore, you should purchase an eToro account with us. We have the most reliable eToro account available for sale.

Final thought

eToro is among the top accounts for trading. The trading platform used by eToro Account is very flexible and well-designed. For experienced traders they can also benefit from sophisticated trading strategies and features. Therefore, you should purchase eToro accounts with us because we offer the most reliable eToro accounts available for sale. Don’t hesitate to make an order to purchase eToro accounts today. We are waiting to receive your order at any time.

Reviews

There are no reviews yet.